Uninsured motorist rates will be driven higher by California's new liability insurance limits

We are past the "Happy New Year" cutoff, but it is not too late for Insurable Interest to take a look at the changes in California insurance law for 2025.

Actually, we are just going to examine the insurance law change likely to impact the most Californians: the increase in mandatory policy limits for motor vehicle liability insurance. I will leave it to others to break down California's new pet insurance requirements. (Well, okay, just one: Stop trying to pass off your "pet wellness program" as pet insurance, you monsters. Insurance Code section 11880.8.)

The new bodily injury liability limits for motor vehicle insurance are $30,000 per person/$60,0000 per accident, doubling the prior minimums of $15,000 per person/$30,000 per accident. California Vehicle Code sections 11580.1(b) and 16056. The property damage liability limits are tripling from $5,000 to $15,000.

The limits had not been increased since 1974, and, I mean, it seems like a good thing to update at least once every half century? Lots of inflation can happen over the course of 50 years, particularly in the realm of emergency health care. Before this change, only Florida had lower limits in each category.

I looked for data on how many drivers carry the minimum limits, but could not find anything reliable. ChatGPT says 15% to 20%, but it also volunteered, unprompted, that California's minimum insurance liability limits for bodily injury are $15,000/$30,000 so who knows where it is pulling data on this topic. (Lest your faith in our forthcoming AI overlords be shaken, know that it totally redeemed itself by nailing "one week" as the appropriate cutoff for offering "Happy New Year" as a greeting after January 1.)

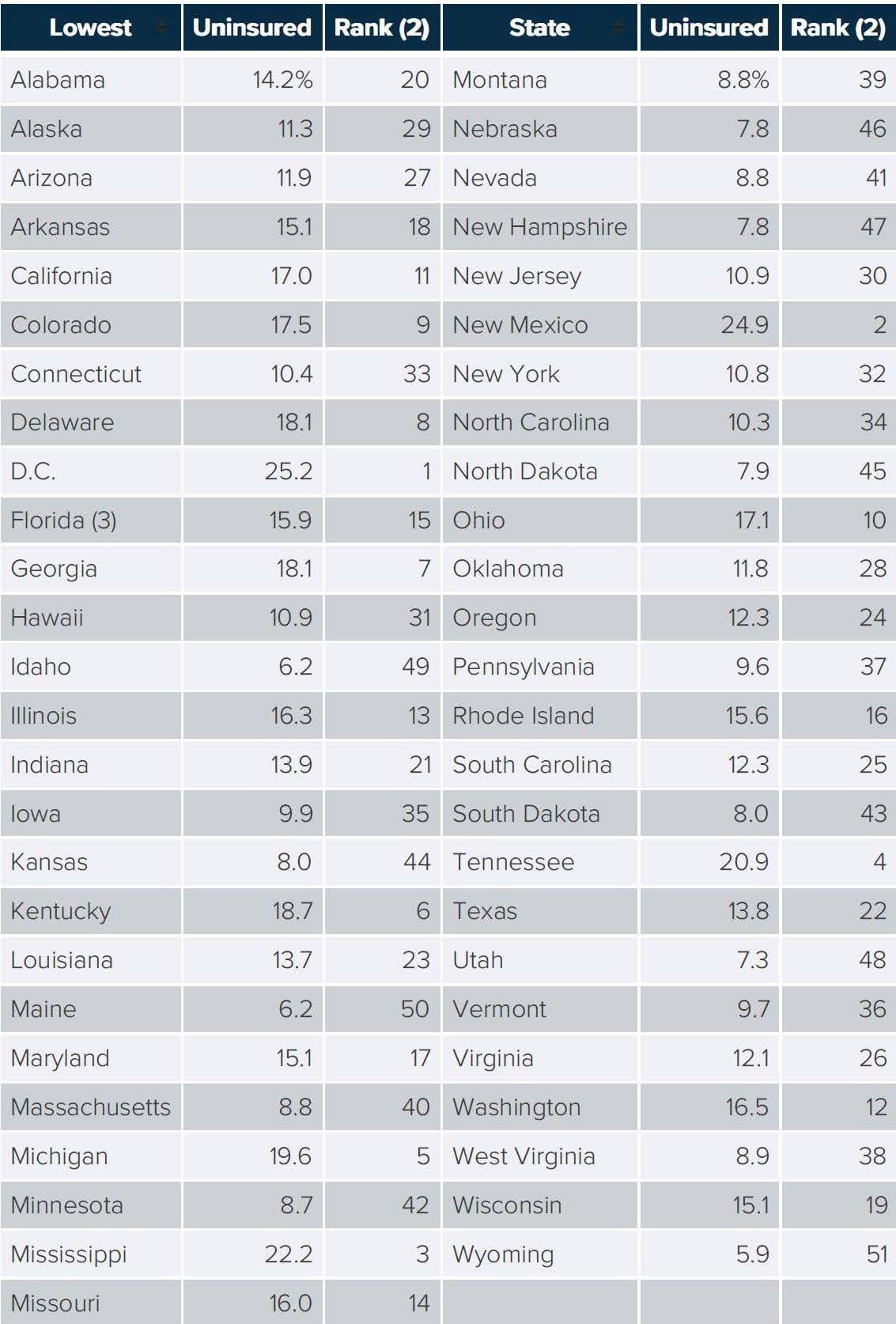

I did find some seemingly reliable data from the Insurance Information Institute on the number of completely uninsured drivers on California roadways. The estimates are troubling, with California estimated to have a 17% uninsured driver rate according to this data from 2022:

Setting aside the fact that no one knows with any actual precision how many uninsured drivers are out there, as a simple matter of economics their numbers are likely to rise in California as a result of the new liability insurance mandates. Increased liability limits means increased premiums , which means more people who chose to forego coverage and exacerbation of the uninsured motorist problem.

That's not to say I'm advocating for another five decades to pass before the limits are increased again. (And it won't as Insurance Code section 16056 has another increase already built in starting in 2035.) $15,000/$30,000/$5,000 was way too low, and the new higher limits do not really feel high enough in a world of $1,900 windshields and pricey emergency room visits.

I think while the Legislature was updating insurance policy limits, it should have also taken a look at the consequences for failing to maintain motor vehicle insurance, which have also failed to keep up with inflation. The penalty for a first offense is no less than $100 and no more than $200. California Vehicle Code section 16029(a). A second conviction within three years increases the potential penalty to no less than $200 and no more than $500. California Vehicle Code section 16029(b). A judge may, upon good cause, also impound the offender's vehicle, which is probably the real threat, to the extent anyone is actually considering consequences when getting behind the wheel in these circumstances. California Vehicle Code section 16029(c)(1). Vehicle Code section 16029 has not been updated since 1997.

Another penalty for uninsured drivers was enacted by voters with Proposition 213, "The Personal Responsibility Act of 1996". Prop 213 prohibited an uninsured driver who was injured in an accident from recovering pain, suffering and other "non-economic" damages in a subsequent lawsuit against the at-fault driver. California Civil Code section 3333.4(a)(3). A few years back there was a trend where injured plaintiffs who were uninsured would, after an accident, post a bond with the DMV , which is an alternative way to demonstrate financial responsibility under California Vehicle Code sections 16021 and 16054.2. They then tried to argue their (lawyer's) posting of this bond brought them into compliance with the financial responsibility laws and eliminated the effect of Prop 213.

I cannot say this tactic never worked, but I am not familiar with a case where an injured driver's post-accident cash deposit with the DMV was found to constitute compliance with California's financial responsibility laws so as to permit recovery of non-economic damages under Prop 213. More often courts found that these post-accident DMV deposits could not "absolve them of their law-breaking" and "render them financially responsible for purposes of Proposition 213". Figueroa v. United States , 2015 WL 11438605 (C.D. Cal. 2015). This result arguably better upholds the whole "take personal responsibility" message that the voters of Prop 213 were presumably trying to send. Though, again, I must question how much Prop 213 is factoring into the decision-making process those who decide to drive without insurance.

On balance, increasing the requirements for liability insurance limits is almost certainly a net positive, but more should have simultaneously been done about the inevitable downstream effects on uninsured motorist rates. Most Californians are also going to want to take this opportunity to also consider the limits of the Uninsured Motorist ("UM") coverage in their own automobile insurance policies.

Endorsements

- The chair of the Insurance Committee of the California Senate is vacant amidst a federal corruption investigation. (CalMatters)

- A lot going on in this story of how internet detectives turned on a hiker who posted a video of the start of the Palisades fire. (Los Angeles Times)

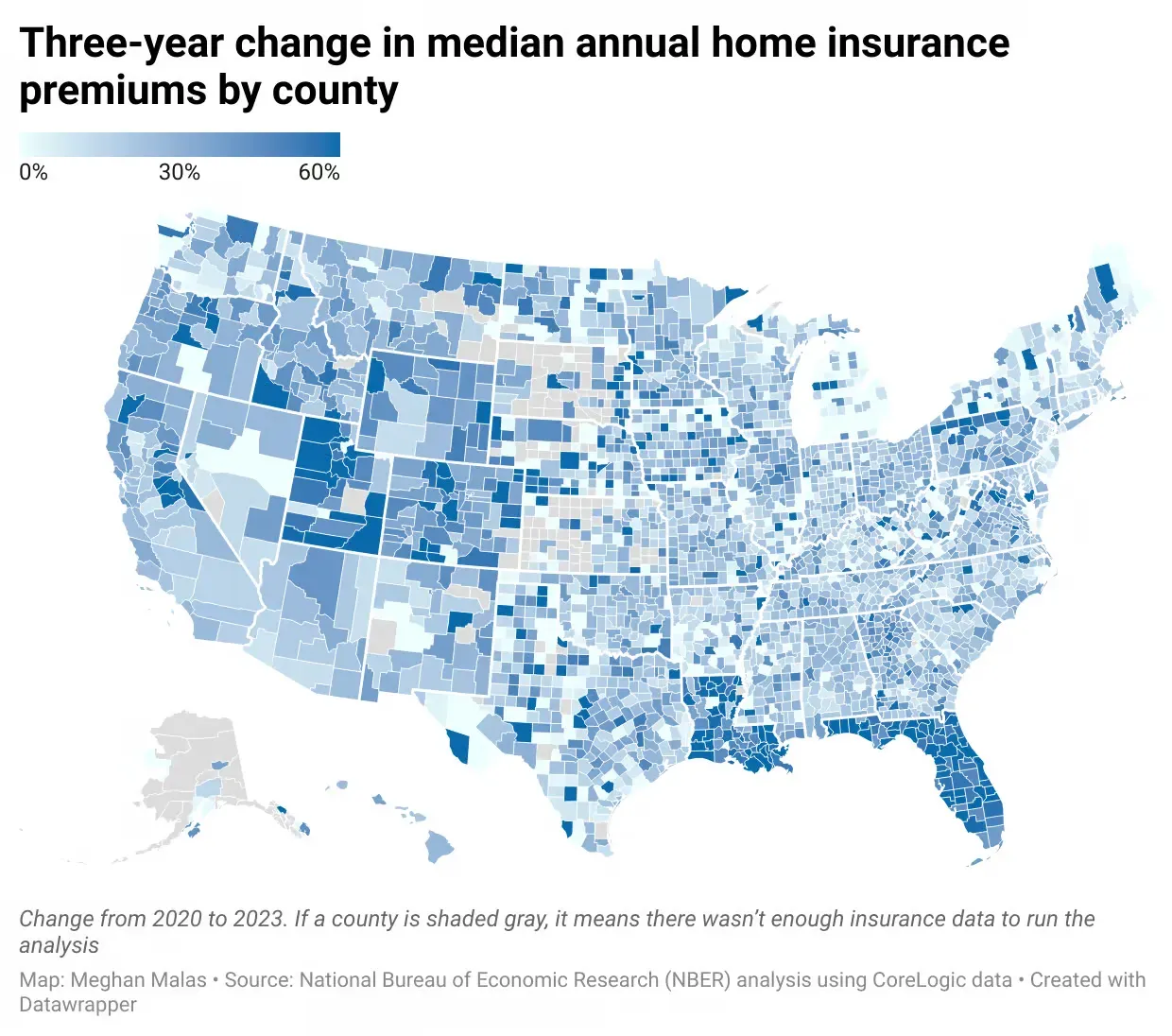

- This article tackles a big question - Why is homeowner's insurance getting so expensive everywhere? It has some very interesting insights and charts, like the one below. But its ultimate conclusion - the written equivalent of a shoulder shrug emoji - is a letdown. (Construction Physics)

Model the Risk

In honor of Saturday Night Live's upcoming 50th anniversary, the most important insurance commercial of all time:

Get in Touch

If the metal ones have not come for you, send coverage cases of interest, news, questions, and comments to: nathan@winegarlegal.com

Do not take legal advice from this or any other newsletter.

Insurable Interest Vol. 3. | © 2025 Winegar Legal P.C.